> 海运服务 > 海运包裹消费税 (GST) > Declare Value of a Parcel for GST Calculation 作者:Taobao shipping Singapore. Freight Forward China to Singapore Sea and Air Parcel Shipping, Taobao China to Singapore Freight Forward Sea Air Parcel Shipping, 淘宝新加坡货运代理公司 - Taobao2SG - 新加坡 发布时间:2024-01-05

4. Some customers asked us why other freight forwarders never mind how their customers declared imported goods' values while Taobao2SG keeps reminding customers to declare accurately. The reason is simple – we, Taobao2SG, are a Singapore-registered company and comply with Singapore laws and import regulations. Those freight forwarders that do not care how their customers declare GST are often China-based forwarders. They are not even a legal entity in Singapore. When their customers’ parcels were inspected and withheld by Singapore Customs for investigation of suspicious under-declaration, those China-based forwarders cannot do much to help their customers. In the end, their helpless customers will lose their parcels (e.g., confiscated or discarded by Singapore Customs) because those China-based forwarders cannot communicate with Singapore Customs on behalf of their customers. Taobao2SG is a local Singapore-registered company. We not only comply with Singapore laws and regulation but also are very seriously about our business reputation as well as responsibility to customers. Your parcels are in good hands with Taobao2SG. We promise to take very good care of our customers’ merchandise and parcels. Thus, we advise customers to declare imported goods' values accurately to avoid unnecessary investigations by Singapore Customs and possible fines or financial penalty.

5. If your parcel is inspected by Singapore Customs, please help to provide proof of purchase value for the inspected parcel immediately.

6. If your parcel has a zero value, such as gift and replacement items sent by the sellers, please provide proof of value of your parcel to expedite the clearance procedure at Singapore Customs. For example, if your parcel was sent by a seller as replacement of faulty items from a previous order, then please provide proof of purchase for the past order and your correspondence with the seller. Without a valid proof, a parcel with a zero value is not going to be accepted for shipping as it will not pass the clearance procedure. Please also do not declare an inaccurate value such as S$ 1 or S$ 0.5 for a zero-value parcel as this will be considered as inaccurately or false declaration.

7. For corporate clients who are GST-registered companies and would like to declare the GST by using their company’s TradeNet account, the client must inform us in advance so that we can arrange independent clearance for the company. The fee for each independent clearance is S$35. The fee is subject to future change if Singapore Customs changes the fee requirement.

8. For Singapore citizens, permanent residents, and long-term pass holders who returned to Singapore from China within last six months and wish to ship their personal belongs back to Singapore, the parcels of personal belongings (e.g., their furniture previously bought and used in China) are free from GST payment. However, the waiving of GST requirement excludes dutiable goods such as motor vehicles (car and motorcycle), cigarettes, wine, and liquors.

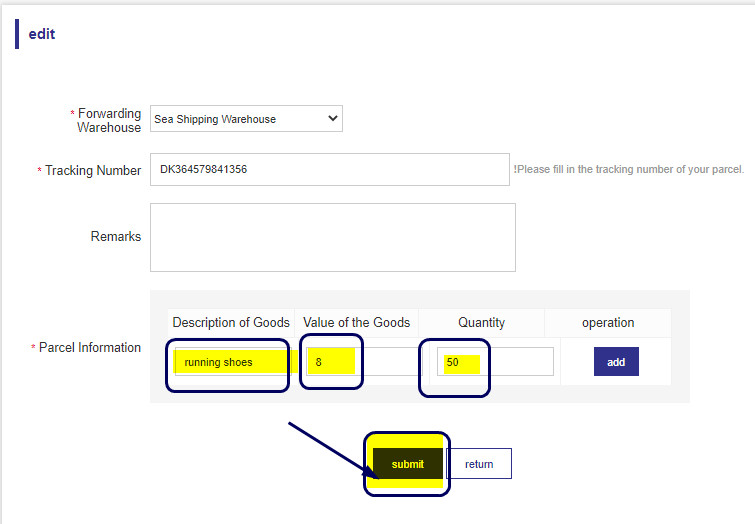

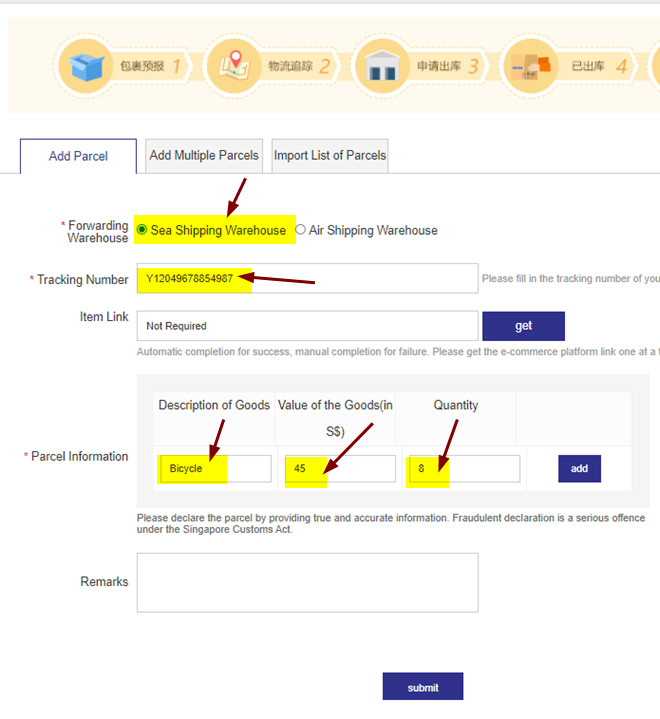

After fill in all the required information, do remember to click the "Submit" button to save the information into your User Center.

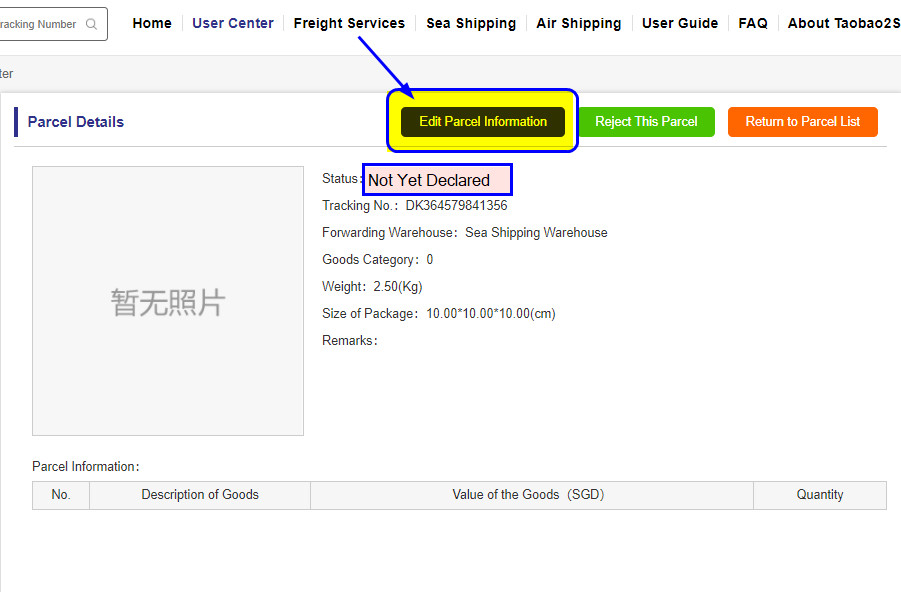

After clicking "Edit Parcel Information", a blank table will appear for you to enter the details (e.g., description of the goods, value per piece and quantity) of your parcel.